According to economists, the concert may have led to a price increase, but other reasons are also at work.

Sweden’s inflation in May surpassed estimates, likely due to a jump in accommodation rates caused by Beyonce’s concert at the Friends Arena in Stockholm.

Statistics Sweden figures released on Wednesday show an 8.2% year-on-year increase in a pricing gauge that excludes energy prices and interest rate impacts.

This gain exceeded both the median Bloomberg poll estimate of 7.8 percent and the Riksbank’s 8.1 percent forecast.

The sudden surge in hotel and recreation expenses may have been influenced by Beyonce’s global tour premiere in Stockholm, which drew over 80,000 people over two days.

“We believe that this unexpected increase will normalise in June as hotel and ticket prices return to normal levels,” said Michael Grahn, chief economist at Danske Bank.

Despite this, Danske expects the Riksbank to raise interest rates further since the Swedish currency’s weakening and persistent inflation remain worries.

Swedbank economist Glenn Nielsen agreed that Beyonce’s performances may have led to higher lodging expenses in May.

He went on to say that the unusually strong price increase was mostly due to high demand and increased cost pressures, which pushed hotels to hike their pricing.

This news on inflation comes at a time when global pricing pressures are lessening.

According to recent data, US inflation has dropped to its lowest level since March 2021.

Similarly, European consumer prices grew less than predicted in May.

Despite these tendencies, Swedish prices continue to grow faster than the central bank’s aim, which is exacerbated by the Swedish currency’s weakness.

This is similar to the situation in nearby Norway, where the cost of imported items has risen owing to currency weakening.

The recent performance of the Swedish krona, which is trading around all-time lows versus the euro, puts more pressure on the Riksbank to maintain a higher benchmark rate than the European Central Bank.

The ECB is anticipated to boost its deposit rate to 3.5% on Thursday, matching the Riksbank, which also forecasts a rate hike this month or in September.

With the most recent pricing data in hand, most analysts expect the Riksbank to announce a quarter-point rate rise on June 29, notwithstanding any brief Beyonce impact.

“May’s inflation figures were higher than expected, given the overall upturn,” Nordea’s Torbjorn Isaksson remarked. “This reinforces our prediction of a Riksbank rate hike in June.”

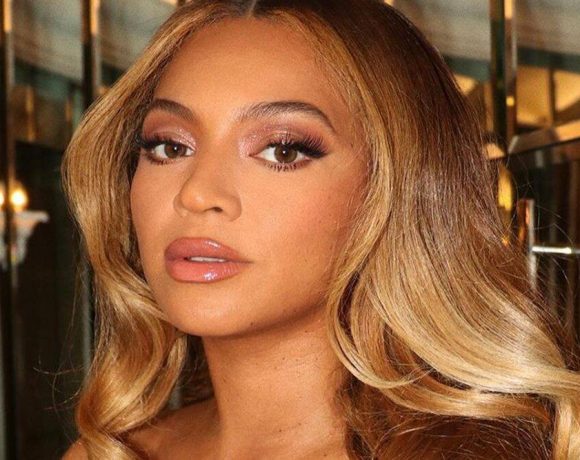

Picture Courtesy: Google/images are subject to copyright